Automated Credit Card Transaction Management

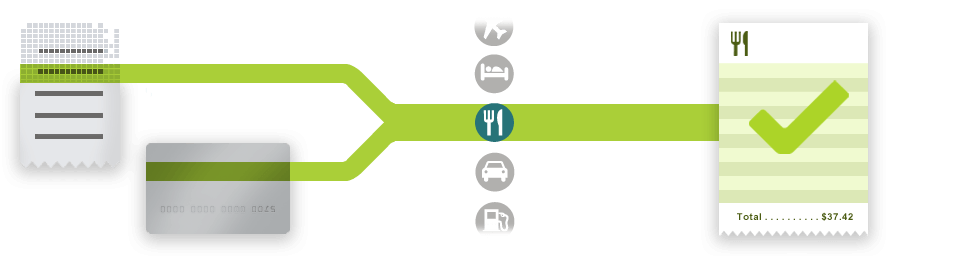

The proportion of business expenses incurred on credit cards has been consistently growing, both in the form of out-of-pocket

personal card charges reimbursable to an employee and in the form of non-reimbursable corporate card charges on credit cards

issued by the business. No matter the type of credit card, Tallie offers automated credit card transaction management, delivering

a streamlined experience for significant time savings.

Corporate Card Transaction Coding

If you work in accounting, you are far too familiar with the manual, laborious process of coding individual credit card

transactions to general ledger accounts. If you're lucky, you might have a direct bank feed set up with Xero or

QuickBooks

Online

, which can pull in your transactions, but you must manually code those transactions in order to close out the

statement

period. If you're unlucky, you're pulling transaction files from bank websites, uploading files, coding them and, heaven

forbid, entering transaction detail manually one-by-one. Finally, you're not the one incurring the charge, so you may not

recognize the merchant at all. Coding the expense now requires tracking down the employee who made the charge in order to

learn its nature to complete your full reconciliation process.

Tallie resolves Corporate Card Transaction Coding for businesses of all types, operating virtually any accounting system,

with enhanced export functionality for QuickBooks Desktop, QuickBooks Online, Xero, and

Intacct

. In Tallie, you can set

up a direct connection to the issuing bank of your company-paid credit cards, then assign each card to the Tallie user account

of the cardholder. Let's say John Smith is your CEO. He'll incur some reimbursable charges on his own and he'll put a lot

of expenses on his corporate Visa card. You can directly connect to the issuing bank, assign the credit card feed to John

Smith and ask John (or his assistant) to review his charges on a monthly basis and submit them with his reimbursable expenses.

Not only can you easily assign the task of transaction coding to your cardholders, but Tallie leverages

auto-categorization

learning algorithms to enhance and streamline your cardholders' experience. Tallie's automated categorization learning algorithms

are two-tiered. First, if one or more expenses have been recorded from a merchant in your company's Tallie account, Tallie

will apply historical expense category or general ledger coding behavior to new transactions from the same merchant. Lacking

company historical data, Tallie retains records of transaction coding across a vast database of credit card merchants and

will apply a best-guess expense category when available. This tranforms the laborious multi-day credit card transaction

coding experience into a check-and-confirm management experience that takes just minutes out of your cardholders' day at

the end of the statement period.

Personal Card Expense Sourcing

Many employees, contractors, interns and volunteers incur expenses on behalf of businesses on their personal credit cards.

Using the same automated bank feed technology as corporate credit cards, Tallie enables all expense submitters to pull in

transactions from the issuing bank as a legitimate record of expense. Finance teams appreciate this feature, particularly

when receipts have been lost or are unavailable.

Receipt & Transaction Automated Matching

Let's say you went to VooDoo Doughnuts in Portland, Oregon to buy some sweets for your team-building exercise. You paid

with your PEX Prepaid Visa Card and took a photo of the receipt with the Tallie app while standing at the register. You

ask the clerk to throw the receipt away for you - you won't be needing it anymore. At the end of the month, when preparing

your expense report for submission, you take a look at your

PEX Prepaid Visa Card expense

report

that Tallie has prepared

for you based on your statement range. Most likely, that receipt from VooDoo is already attached to the transaction recorded

from the VooDoo merchant.

Tallie leverages comparison technology to identify expenses with similar merchant, date and amount characteristics and flag

these expenses as Possible Duplicates. In the case of a credit card transaction, if an exact match is made to a receipt

transaction, the match between the duplicates is made immediately. Receipt & transaction auto-matching grants piece of mind

to you as an accountant, vastly decreasing the likelihood of employees receiving reimbursement for expenses they did not

occur out of pocket.

How-To Guide to Tallie Credit Card Functionality

Tallie makes it easy to import expenses from your credit cards. Chose your bank from a list of the most popular banks, or

type in the name of your bank or the url of your bank's website. You'll get a list of banks to choose from, and then it's

a matter of logging in using your bank credentials and then simply importing the expenses. You can decide to auto import

all expenses, or selectively import your credit card expenses one by one.

Tallie supports these popular credit cards, and many, many more:

Can't find your bank? Tallie offers manual import of your credit card transactions by uploading a CSV, OFX, QIF, QFX, QBO,

or Microsoft Money file. All you have to do is export your expenses from your bank in one of the supported file formats.

You can drag and drop the support file type onto the window, or click on the upload icon to import from your file location.